An Innovative Way to Encourage Disaster Preparedness: FEMA’s Public Assistance Deductible

The Federal Emergency Management Agency (FEMA) recently outlined a new framework called Public Assistance program for providing strong incentive for states to invest more in pre-disaster preparedness measures that would help limit harm to people, property, and natural functions of ecosystems over the long-term and ensure that taxpayer dollars are spent wisely.

It provides funding for local, state, and tribal governments to help communities recover from major disasters. The PA program provides funding for debris removal; life-saving emergency protective measures; and the repair, replacement, or restoration of disaster-damaged publicly owned facilities and the facilities of certain private non-profit organizations.

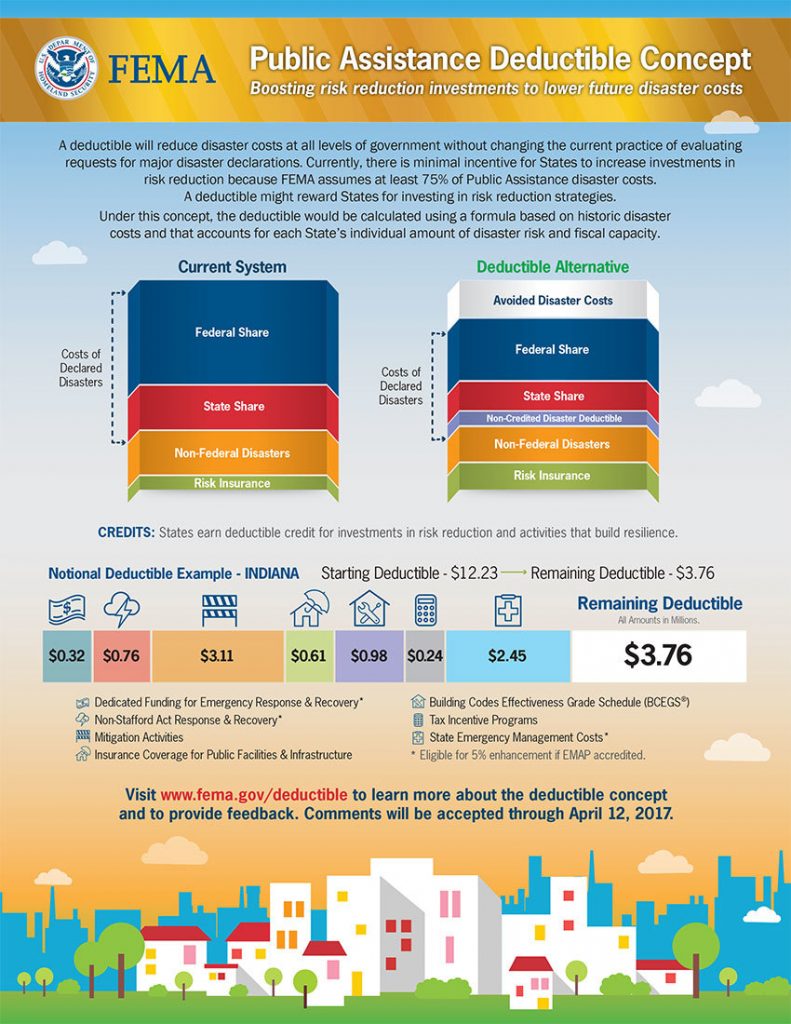

Federal taxpayers pay for at least 75 percent of the eligible costs, and state and local entities pay the rest. Under FEMA’s proposed design for this deductible, states would first have to meet a minimum threshold of expenditures on post-disaster recovery before FEMA would provide federal assistance through the PA program.The truly innovative part of the proposal would be that FEMA would allow states to buy down their deductible through credits earned for state-wide measures that would help build resilience and lower the costs of future disasters.

UCS supports the concept of a well-designed deductible for the PA program and believesthat this could be an effective way of addressing a number of priorities for reform of federal disaster funding previously identified by various authorities. The PA deductible program would give states an incentive (through the crediting mechanism) to take pre-disaster protective actions to make communities more resilient to disasters.

Reference Link: http://blog.ucsusa.org/rachel-cleetus/an-innovative-way-to-encourage-disaster-preparedness-femas-public-assistance-deductible